To Achieve Serious Wealth You Need One Thing More Than Anything Else

Making money isn’t everything, but it helps in many areas of life. Like paying medical bills, having a nice home, paying for your kids’ college education, enjoying a nice vacation, or not experiencing financial stress in old age.

There’s a funny thing. There are certain rules to money. And there is one rule that rules them all.

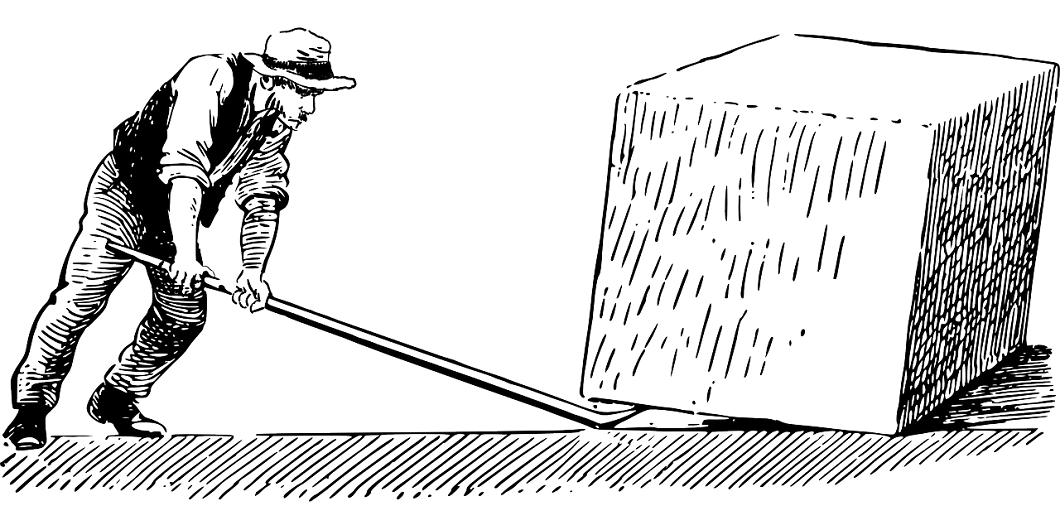

If you want to make serious money, get yourself in a position of leverage.

What do I mean by leverage? You control significant resources.

Extreme Examples Of Leverage To Achieve Wealth

- When you are the CEO of a major company, you have thousands of people all working and creating value at massive scale. Inevitably, when you are in charge of something at scale, significant resources come your way (in salary and stock). That’s leverage.

- When you start a restaurant that you then replicate scores or hundreds of times through franchises or by owning the entire chain, you have thousands of people working for you and millions of dollars flowing in. Again, that’s leverage–and it contrasts mightily with owning just one restaurant.

- When you are a star like Katy Perry and millions of people flock to your new videos and songs–and eventually attend your concerts and buy your music, that’s the leverage of attention at scale.

- When you are a venture capitalist and buy 20 percent of a company for $500,000 that eventually grows to employ thousands of people and make millions or billions in revenue, you then own a piece of something operating profitably at scale. That is immense leverage.

- When you are a hedge fund manager and control billions of dollars in investments (of other peoples’ money!) and keep 20 percent of the profit, that’s extreme leverage.

- When you place yourself as a middleman in Wall Street when a country or company sells billions of dollars in bonds, the small slice that your firm in the middle takes home is worth tens of millions of dollars (if not more). You enjoy the leverage of taking a piece of large amounts of cash changing hands.

- A real estate agent in the middle of millions of dollars a year in housing being bought or sold makes 3 percent of all those transactions. Again, you enjoy the leverage of taking a piece of large amounts of cash changing hands.

- When you sell a product that reaches millions of people, even if it is an inexpensive product, that’s leverage (due to scale).

- If you can consistently write books that millions want to buy, that’s the leverage of attention and interest at scale.

- Extreme competence can also serve as leverage. Professional athletes enjoy that type of leverage. Or, if you are the best knee surgeon in the world, you will make a lot of money. But you know what’s interesting, even though that knee surgeon has incredibly useful skills, he will never make truly massive money. There isn’t enough leverage selling his services on an hourly basis for extreme leverage.

- Owning lots of real estate provides the leverage of taking a piece of the cash flows involved. If you use debt to purchase the real estate, this also allows you to control more property that you would otherwise. This is literally financial leverage, but also leverage in the sense I’m describing in this post.

More Moderate Examples Of Leverage

I recognize that the above are extreme examples, but the concept of leverage applies to everybody. If you don’t intend to create a company or product yourself that has significant leverage, then work for a company that has this leverage.

- Google has leverage due to market dominance. Due to the fact that its product is software (which can be deployed at scale at very low cost). Due to the fact that billions of people use its product. You work for a firm like that, you make way more money than if you work for a company that sells tires locally. You see the difference?

- Working for government also has leverage. Why? Because government holds the monopoly on taxation. It’s operations are not subject to the pressures of market competition. Government can pay well above average salaries because they are free of these economic pressures. For the same reason, they can pay health care and pensions in retirement. The power of taxation and exemption from competition are also forms of leverage.

- If you work for a highly successful firm (or the government) for several decades, there is another kind of leverage. Benefits after you retire. That pension and health care after leaving employment represent the leverage you have by being associated with a firm with 50,000 employees working hard into perpetuity. Contrast that with a gig economy worker. The moment they stop working, they get nothing. No leverage.

- Owning rental real estate even on a small scale provides you with leverage. It has the added benefit of being relatively passive in that it doesn’t require full-time work to maintain the asset.

If you look at the above examples, you will notice that leverage tends to concentrate in certain sectors. Technology, Finance, and Real Estate. This is why so many ambitious people pursue careers in these fields. That’s where you can find the leverage.

So if you do want to build serious wealth, ask yourself the following questions.

–Do my skills allow me to work for a firm that has significant leverage?

–Do my skills command attention at scale?

–How much leverage does my company have?

–How much leverage and scale does my industry naturally enjoy?

The Leverage Formula For Building Wealth

Here’s a simple recipe to achieve financial independence based on the concepts outlined in this post.

1. Make lots of money through leverage. You can do this by A) creating something as an entrepreneur that has leverage (scale, large cash flows, massive attention), B) working for a firm with that enjoys leverage, or C) having skills so unique that they earn a premium return on your time (this is rare).

2. Save a large portion of what you earn and plow that into investments that take advantage of leverage–such as successful technology companies, real estate, etc. Even investing in index funds is a leveraged activity. When you own an index fund that invests in the entire U.S. economy, you are enjoying the benefits of millions of people working and creating value and profits over time.

3. With the passage of time, as you combine items one and two you grow wealthy.

So the formala is: leveraged earnings + investments + time = wealth.

It’s really that simple.

Got Leverage?